You can use the following order types in the standard system:

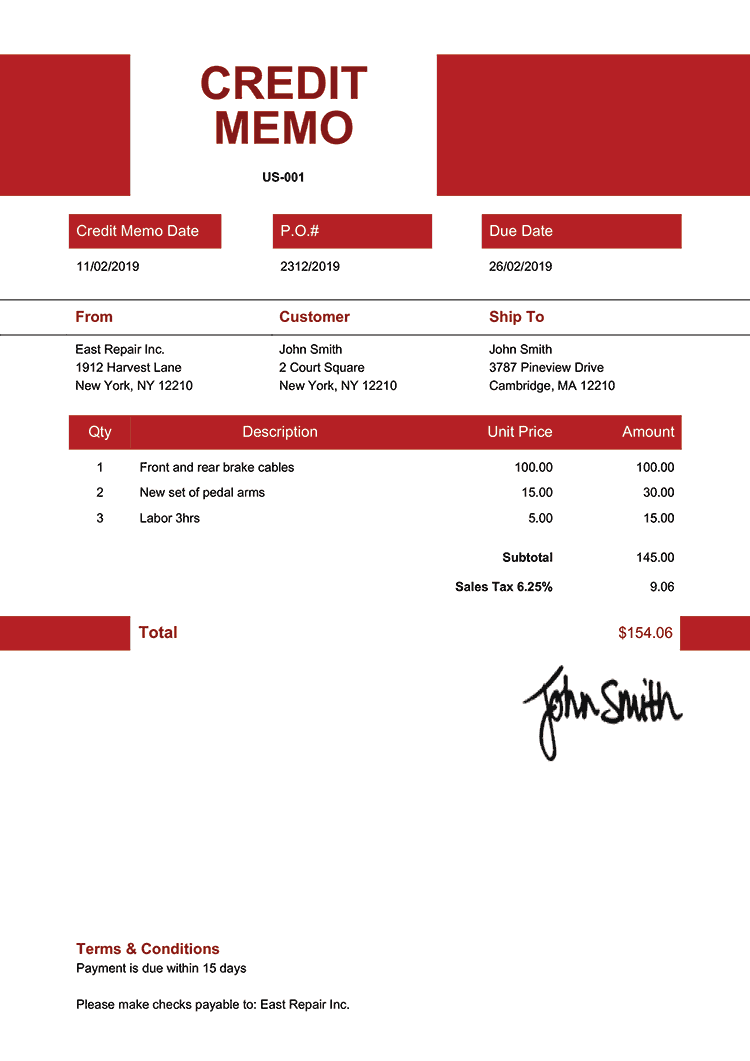

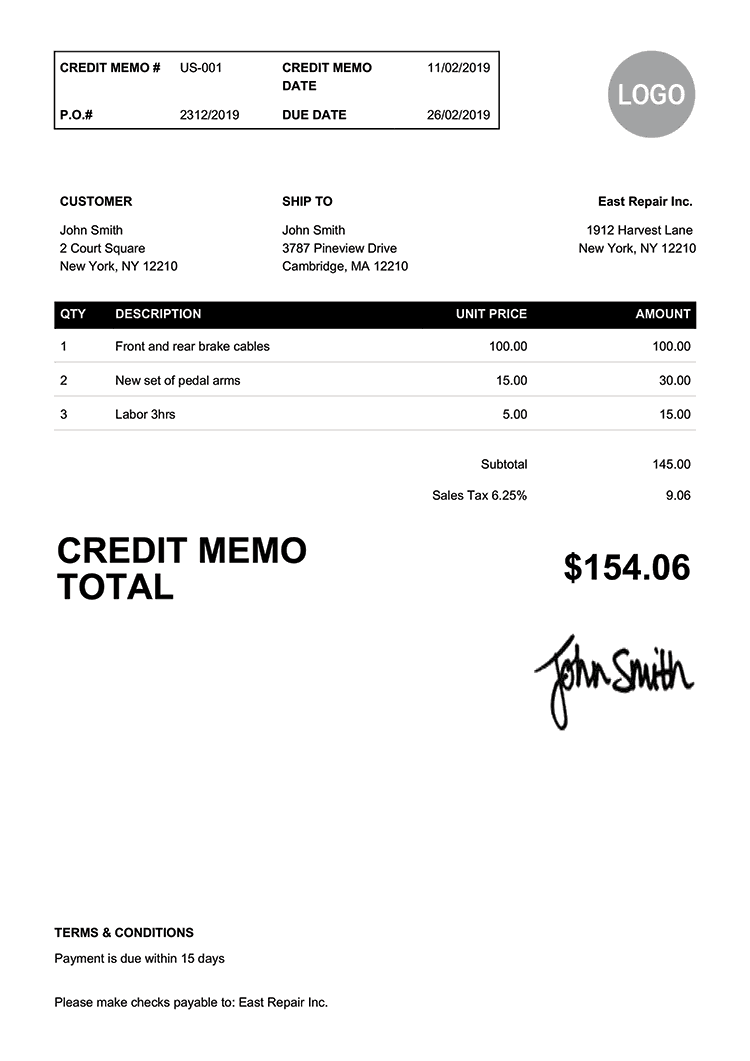

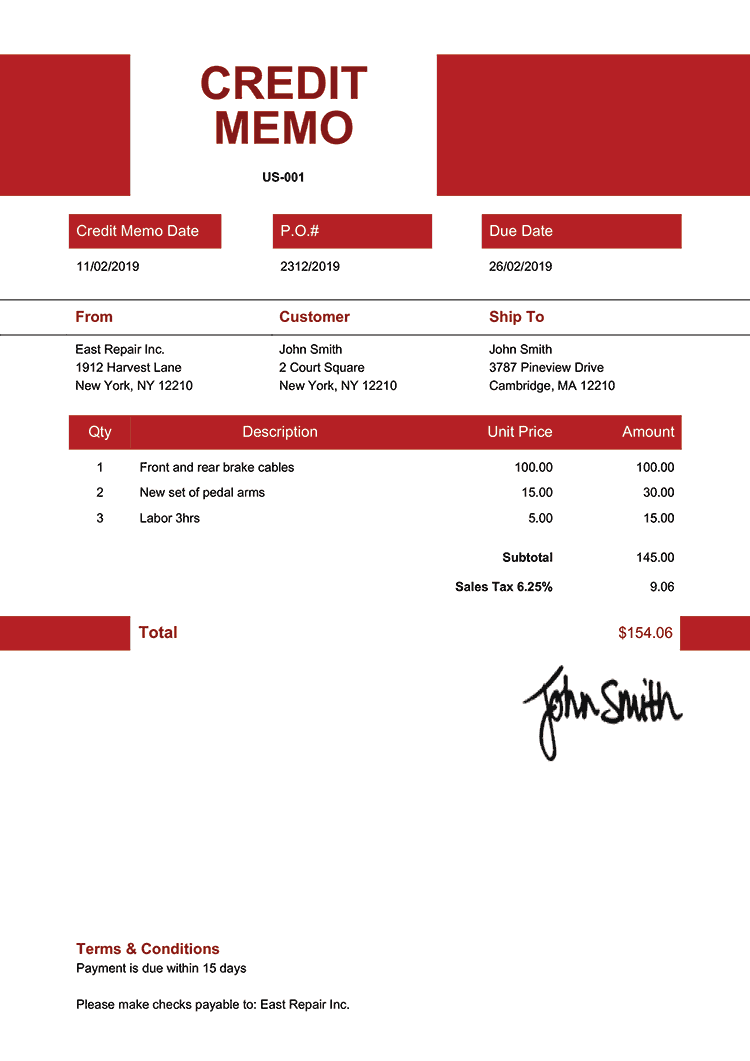

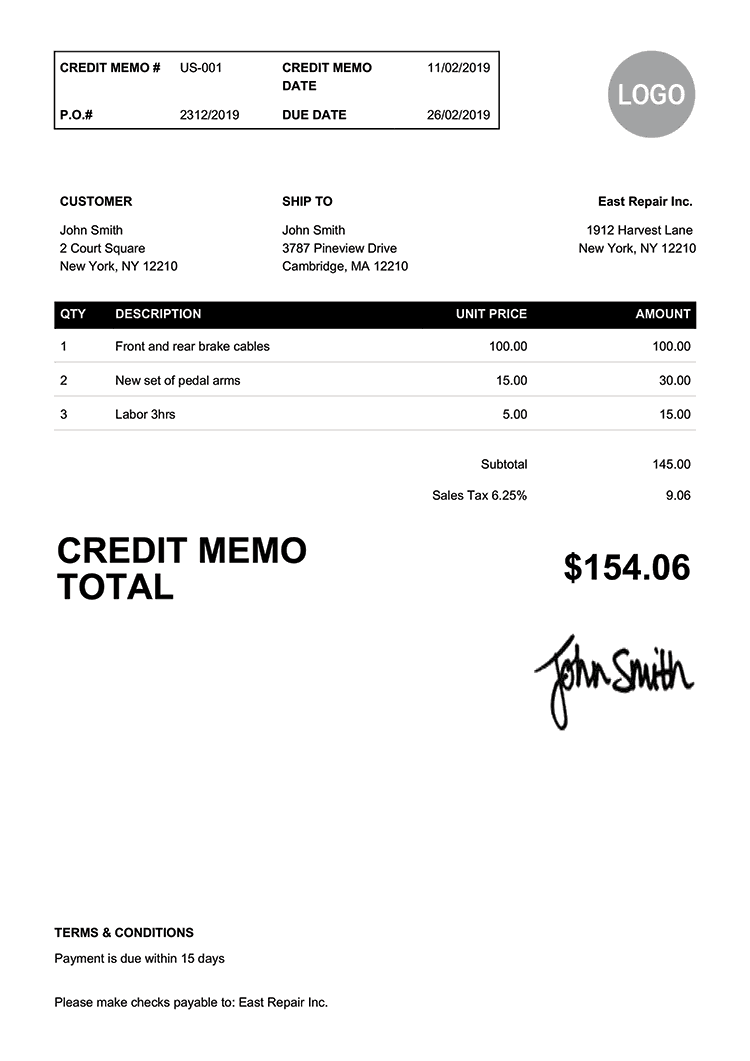

Use the same procedure that you use for creating sales orders. Sales orders – Contracts – Contract release orders – Billing documents.  With reference to a preceding document, such as:. Without reference to a preceding document. You can enter a credit or debit memo request in one of the following ways:. How to creating Credit and Debit Memo Requests ? The system uses the credit memo request to create a credit memo.

With reference to a preceding document, such as:. Without reference to a preceding document. You can enter a credit or debit memo request in one of the following ways:. How to creating Credit and Debit Memo Requests ? The system uses the credit memo request to create a credit memo.

If the request is approved, you can remove the block.

The credit memo request is blocked for further processing so that it can be checked. If the price calculated for the customer is too high, for example, because the wrong scale prices were used or a discount was forgotten, you can create a credit memo request. Credit memo request is a sales document used in complaints processing to request a credit memo for a customer. A debit memo is a transaction that reduces Amounts Payable to a vendor because, you send damaged goods back to your vendor. Credit Memo – A transaction that reduces Amounts Receivable from a customer is a credit memo. The system uses the debit memo request to create a debit memo. When it has been approved, you can remove the block. The debit memo request can be blocked so that it can be checked. If the prices calculated for the customer were too low, for example, calculated with the wrong scaled prices, you can create a debit memo request. Debit Memo – It is a sales document used in complaints processing to request a debit memo for a customer. This increases receivables in Financial Accounting. Debit memo: A sales document created on the basis of a customer complaint. This reduces receivables in Financial Accounting. Credit memo: A sales document created on the basis of a customer complaint. How to creating Credit and Debit Memo Requests ?Ĭredit memos and Debit memos are part of Billing Process in SD life cycle. Speed up your workflow and explore what more you can do with Acrobat Sign today. Keep business transactions moving.Īcrobat Sign makes it easy to create notes and invoice templates, share and receive documents, and sign and send invoices - from nearly every device and from just about anywhere. No actual money is exchanged with a credit note rather, it’s used to offset a previous invoice that’s already been paid. Pricing mistakes on the original invoice. Changes to an order after an invoice is issued. As a seller, you may issue a credit note when there’s a need to cancel all or part of an invoice for a variety of reasons, including: You might notice these referred to as credit memos, too. What’s a credit note?Ī credit note is a document issued by a seller to a buyer to notify that credit is being applied to their account. In this case, the buyer issues the debit note to the seller. The debit note ‘makes note’ of the transaction for documentation purposes.ĭebit notes are also used in business-to-customer transactions, such as when a customer returns goods to a business received on credit. You’ll commonly come across these notes in business-to-business transactions - for example, one business may supply another with goods or services before an official invoice is sent. What’s a debit note?Ī debit note, or a debit memo, is a document issued by a seller to a buyer to notify them of current debt obligations. They’re also critical to shipment tracking, payments due or if any credit remains on the account. Separate from an invoice, these notes let buyers know how much existing business credit they have or conversely, how much they still owe. CREDIT MEMO PLUS

credit note: What’s the difference?Įxplore the difference between a debit and credit note by learning what each term means, plus when and how businesses should use them.īoth debit notes and credit notes are official accounting documents, both used by businesses but for different purposes.

0 kommentar(er)

0 kommentar(er)